Just as a disclaimer, I’m not a professional trader, just a guy who has been doing this off and on for a few years. In the near future, my plan is to make some big trades with large amounts of my savings. The first of these big trades will be when I feel that Bitcoin has hit it’s next bottom, that’s when I’ll be making a substantial trade. Perhaps 30% of my life savings will be risked on this swing trade.

When I blog about trading here, I’ll be sharing with you guys what I’ve learned and telling you exactly what trade I’ll be making and when. Perhaps you could call it my trading journey, from beginner to billionaire (or homeless bum).

The strategy is Swing Trading. Plus I’ll only be making one massive trade, when the crypto market hits the next bottom. Then riding it until the next top and selling. Now, the other undecided aspect of this upcoming trade is whether I’ll be buying only Bitcoin or diversifying amongst a select basket of cryptocurrency’s.

Whatever choice I make will be blogged right here for everyone to see and for my own record. In the future, I’ll be able to look back and have an accurate understanding of what holes in my knowledge need to be filled etc.

What is Swing Trading?

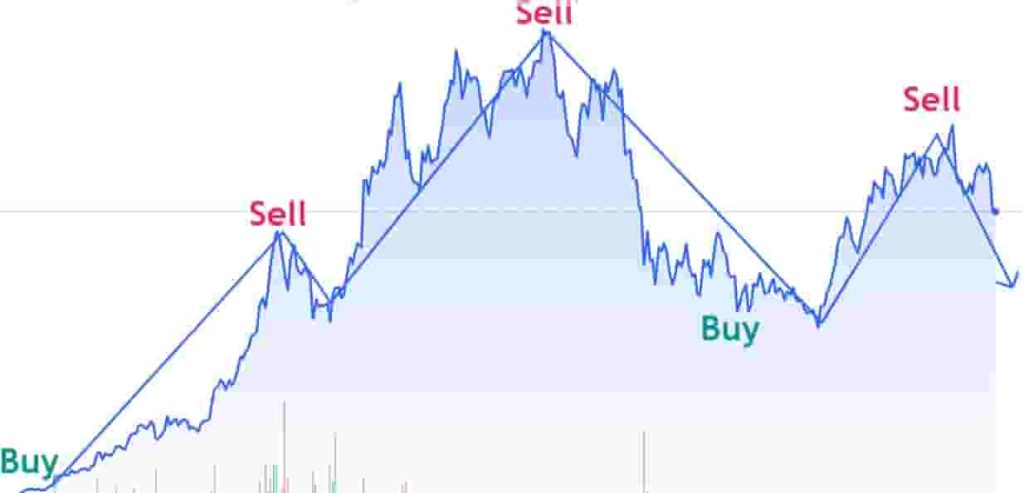

Swing Trading Cryptocurrency is a longer than average buy and sell strategy, where buying low and selling high can take 6 months or more. Picking something to trade that has a bullish moving average is also required. This is also a strategy based heavily on technical analysis. Which is making predictions on the future, based on past data and moving averages.

I’m definitely not an expert in trading in any way shape or form, but from my experience this seems to be the safest strategy for trading cryptocurrency. Most people who dabble in crypto, end up getting burned badly, it’s a tough space to make money, that’s for sure.

Swing Trading V Day Trading

The shorter the time frame, the higher the risk and the more skill/experience you will need in order to be successful. Therefore the most risky strategy of all, is day trading, under no circumstances should any newbie day trade. Leave day trading for the experts, as it’s by far the most dangerous strategy you could have.

How Does Swing Trading Work?

Let’s start with a more shorter term swing trade, still shorter than what I would usually recommend.

If you have a look at the example below. Usually after a big sell off, buying in at the bottom would result in a rebound. Many traders use the relative strength index (RSI) as another key indicator to help in making their decision. The RSI gauges how much velocity there is in price movements both ways, the higher the velocity, the more likely a rebound will occur.

Even though this is less risky than day trading, it’s still got a high amount of risk involved.

Best Swing Trading Strategy

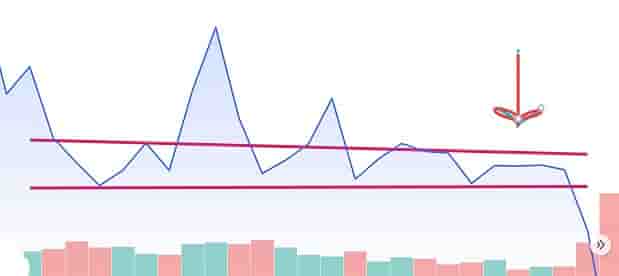

To start with, from my research, we need to try identify what type of market environment we are in. Some call it the moving average, running average or rolling average. Whatever it’s called, these two red lines below can be used to help a trader figure out which direction the trend is going.

- Uptrend Market

- Ranging Market

- Downtrend Market

Now that we have identified which direction the market is trending, the next step is finding where the supports are. In a ranging market, the support will be at both ends. When you look at the chart below, you can see the market is pretty much going sideways until it hits the arrow. There is a gap between the top support, which is a sign the market is about to drop.

Disadvantages of Swing Trading

- Having live trades while you are not monitoring them

- Your capital is not sitting there ready to be used

- Less exciting

These are the biggest two arguments against longer term trades, but I’d argue that holding for a longer term can be safer, especially when you have bought in low enough. The third one is used commonly as well, which is a sign that trading isn’t all about, making intelligent decisions, a large part is emotional.

Another thing that you should be aware of is, whenever a new retail trader makes a buy, the platform takes a cut. This is why the riskiest strategy (day trading) is pushed the most by trading gurus. I could be wrong, but this seems like an incentive for every platform to convince people to buy more frequently, even if it’s not in their best interest to do so.

My Bitcoin Prediction

Just a reminder, I’m definitely not giving financial advice, nor am I a crypto expert. You are welcome to follow my journey here via my blog posts, but please don’t risk any of your money based on my newbie thoughts.

If you have a look at the graph below, I’m hoping to find the bottom of Bitcoin late this year, to early 2022. Ideally around 10-20k would be nice and if that was to happen, I’d be all in, allocating a large amount of my savings to Bitcoin. Depending on what happens, my backup plan is to wait for an alt-coin bottom and evenly diversify my savings among a select few coins.

Australia has become a totalitarian dictatorship nightmare recently, not to mention the rapidly deteriorating geopolitical situation in Asia and the middle east. This mixed in with an arms race kicking off in Asia, all seem to be reasons to be bullish on bitcoin.

Gold seems to be corrupted by market manipulation, which has caused people to lose all trust in all precious metals too. Gee, perhaps all my predictions could be totally wrong.

Here are some other technical analysis articles I’ve made for you:

- How to use support and resistance in technical analysis

- What is Dow Jones Theory?

- Eliott Wave Theory in technical analysis

- How to swing trade cryptocurrency

- What is the Bull Trap?

- How to trade the relative strength index (RSI)?

- What is the rising wedge?

- How to trade the head and shoulders pattern?

- How to be a Bitcoin millionaire

Anyway, keep in touch, thanks for reading.

Hey Dave,

My husband Alex and I are interested in your crypto idea, I have been following you over the past couple of years but haven’t been getting many notifications from YouTube, plus I have heard that YouTube also deletes members of certain channels.

BTW, we are dreaded boomers who saw the writing on the wall a while ago…